Trade Credit Limit for Courier Business [Challenges Solved]

![Trade Credit Limit for Courier Business [Challenges Solved]](https://mversesolution.com/wp-content/uploads/2024/09/Trade-Credit-Limit-for-Courier-Business-Challenges-Solved-770x400.webp)

Trade Credit Limit for Courier Business [Challenges Solved]

What is Trade Credit?

A business loan is an agreement between a lender and a borrower that provides credit to the borrower for purchasing goods or services and making payments later. It comes into play when a borrower acquires equipment, machinery, supplies, and other products. The loan terms are determined based on the borrower’s business requirements, existing assets and liabilities, financial stability, and the customer’s creditworthiness.

In 2023, the market for trade finance in India was valued at approximately 1.2 billion USD. It is expected to expand at a compound annual growth rate (CAGR) of 5.55% from 2024 to 2030, reaching a projected size of 2.4 billion USD by 2030.

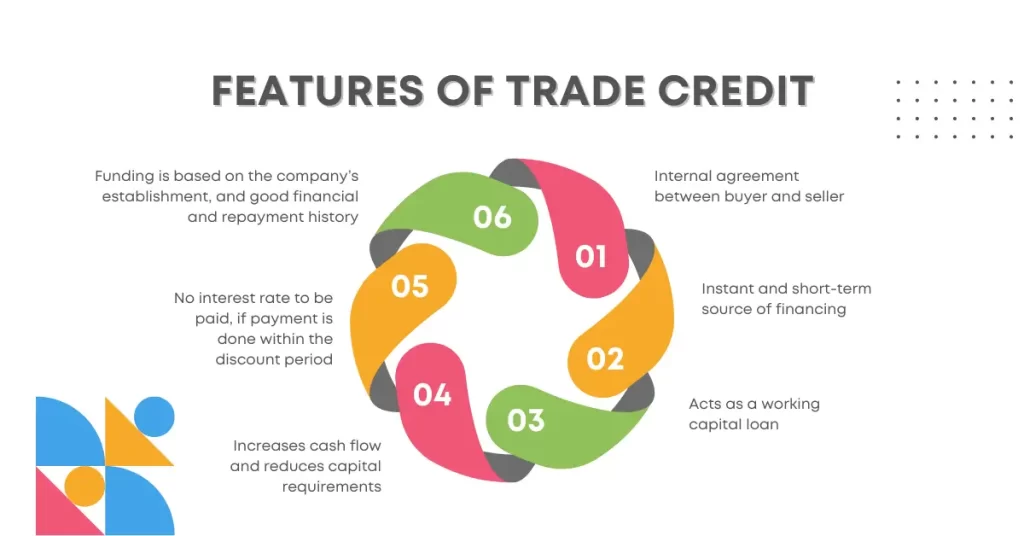

Features of Trade Credit

- Internal agreement between buyer and seller

- Instant and short-term source of financing

- Acts as a working capital loan

- Increases cash flow and reduces capital requirements

- No interest rate to be paid, if payment is done within the discount period

- Funding is based on the company’s establishment, and good financial and repayment history

Trade Credit in Courier Industry

In the courier industry, trade credit ensures seamless business operations between suppliers and buyers. It involves an agreement where either a courier company or a goods supplier extends credit to customers, enabling them to receive goods or services in advance and settle the payment later within a timeframe. The most successful businesses handle their cash flow effectively, allowing them to maintain operations without making immediate cash payments for courier services or products.

Granting trade credit can strengthen the bonds between suppliers and courier companies with their clients, fostering trust and encouraging repeat business. The key challenge lies in managing trade credit efficiently, as it entails evaluating the risks associated with late payments or defaults. Typically, credit limits are established along with payment terms to help businesses mitigate risks while maintaining a balance between customer satisfaction and financial stability.

In the international courier industry, trade credit comes into play, enabling businesses to tackle challenges posed by large shipments and financial issues faced by couriers. This system is particularly tailored for smaller companies. There are instances when they don’t have cash readily available to fulfill urgent delivery requests from customers.

Problems related to trade credit in courier industry:

1. Delayed Payments:

– Cash Flow Issues: When customers need to make payments, it can create issues for couriers in managing their cash flow. This can impact their capacity to cover essential operational costs such as fuel, maintenance, and employee salaries.

– Operational Disruption: Consistent delays in receiving payments can disrupt the quality of service provided or even halt operations altogether.

2. Credit Risk:

– Customer Insolvency: If a customer files for bankruptcy or encounters money troubles, it could result in unpaid bills.

– Unverified Creditworthiness: Granting credit without thoroughly evaluating a client’s creditworthiness can heighten the likelihood of incurring bad debts.

3. Dispute Resolution:

– Billing Discrepancies: Disagreements regarding fees or mistakes in billing can lead to payment delays and strain customer interactions.

– Service Quality Disputes: Disputes regarding the service level or the delivery speed can result in postponed or withheld payments.

4. Credit Terms Management:

– Inconsistent Terms: Having various credit terms for clients can make managing finances and predicting future outcomes challenging.

– Ineffective Credit Policies: Inadequate credit policies or inconsistent application of them can result in poor handling of credit risk.

5. Impact on Relationships:

– Customer Relationships: Implementing credit control measures could strain client relationships, which may affect future business opportunities.

– Supplier Relationships: When trade credit problems result in delayed payments to suppliers, they can damage those relationships and affect the quality of service or expenses.

6. Administrative Burden:

– Invoicing and Follow-Up: Handling bills, monitoring payments, and contacting overdue accounts can take a lot of time and resources.

– Accounting Complexity: Keeping track of records and handling accounts receivable can get tricky, mainly when dealing with different credit terms and payment habits.

7. Legal and Compliance Issues:

– Collection Procedures: Enforcing collection methods or pursuing legal measures to retrieve late payments can be expensive and lengthy.

– Regulatory Compliance: It can be quite a task to navigate and adhere to the financial regulations and laws across various regions.

8. Market Competition:

– Competitive Pressure: Providing attractive credit conditions in an industry could be essential to attracting or keeping customers. However, this comes with the downside of a higher likelihood of payment delays.

Leverage Trade Credit in Courier Business with Shippoing

Optimize Invoicing with Precision and Speed

The cause of payment delays can often be traced back to a billing system. Shippoing addresses this issue by offering a user-friendly solution for generating invoices promptly and accurately. With pre-designed templates, you can create polished invoices in just a few clicks. You can also set up billing cycles to send reminders for timely follow-ups on your invoices. This not only minimizes mistakes but also accelerates payment processes and boosts cash flow.

Mitigate Credit Risk Effectively

To prevent issues with lousy debt, evaluating and handling credit risk effectively is crucial. Shippoing provides you with analytics resources to monitor your clients’ financial well-being continuously. Evaluate the creditworthiness of your clients before granting credit to make informed choices that consider the potential risks of delayed payments or nonpayments. Safeguard yourself from dues by utilizing credit assessments based on data and secure your financial future in advance.

Resolve Disputes with Efficiency

Delays in payments could occur and, even more concerning, it might tarnish your relationships with clients. Shippoing offers a single platform for all integrations whether it’s on the client side or within the organization to handle and address disputes. Keep a record of every interaction to swiftly and amicably resolve issues. This approach aims to enhance customer satisfaction and facilitate smoother transactions.

Manage Credit Terms with Flexibility

Managing finances can be tricky since clients have varying preferences regarding credit terms. However, with Shippoing, you can effortlessly establish and uphold credit terms tailored to each client. You can set and implement credit guidelines, ensuring your operations run seamlessly. This level of adaptability enables you to cater to a range of customer requirements without losing control over credit management.

Strengthen Customer Relations

Maintaining solid relationships with customers and suppliers is crucial for success. Shippoing provides a platform for invoicing, monitoring payments, and tracking communication. This ensures that payments are received on time and that communication is transparent, which helps establish trust and nurture lasting partnerships throughout the supply chain.

Reduce Administrative Burdens

Managing trade credit can be quite an administrative task. That’s where Shippoing comes in with its user-friendly interface and automation features to streamline the process. Our app helps you save time and takes care of all the repetitive tasks like invoicing, sending reminders, and following up. Experience increased efficiency and reduced operational costs with shippoing.

Ensure Compliance with Ease

Managing things can be challenging, and following rules is crucial. Shippoing makes compliance hassle-free. Our tools and resources are up-to-date and straightforward. Our app maintains records, making audits easy and ensuring you’re on the right side of the law.

Stay Competitive with Smart Solutions

Advantageous credit conditions give you an edge in the competitive landscape. With Shippoing smart solutions, you get a mix of credit options and robust risk management. Stay ahead of the game while ensuring safety through the functionalities of our app.

How Shippoing Enhances Trade Credit Management?

The Shippoing’s online shipping management system platform creates a system for managing trade credit limits that are seamlessly integrated with financial processes specifically designed for courier and logistics firms. This allows businesses to conveniently establish, monitor, and modify credit limits, ensuring they have complete oversight to minimize potential financial risks associated with credit.

This is done through the management of the trade credit limit, which enables companies to improve their cash flow, strengthen their business relationships, and boost their overall operational effectiveness. This capability will definitely prove valuable in handling demand fluctuations and ensuring financial stability in a competitive marketplace.